net investment income tax 2021 calculator

Calculate the taxes already paid during the financial year such as TDS advance tax self assessment tax. This calculator reflects the Metro Supportive Housing Services SHS Personal Income Tax for all OR county residents on taxable income of more than 125000 for single filers and 200000 for head of householdmarried filing jointly filers.

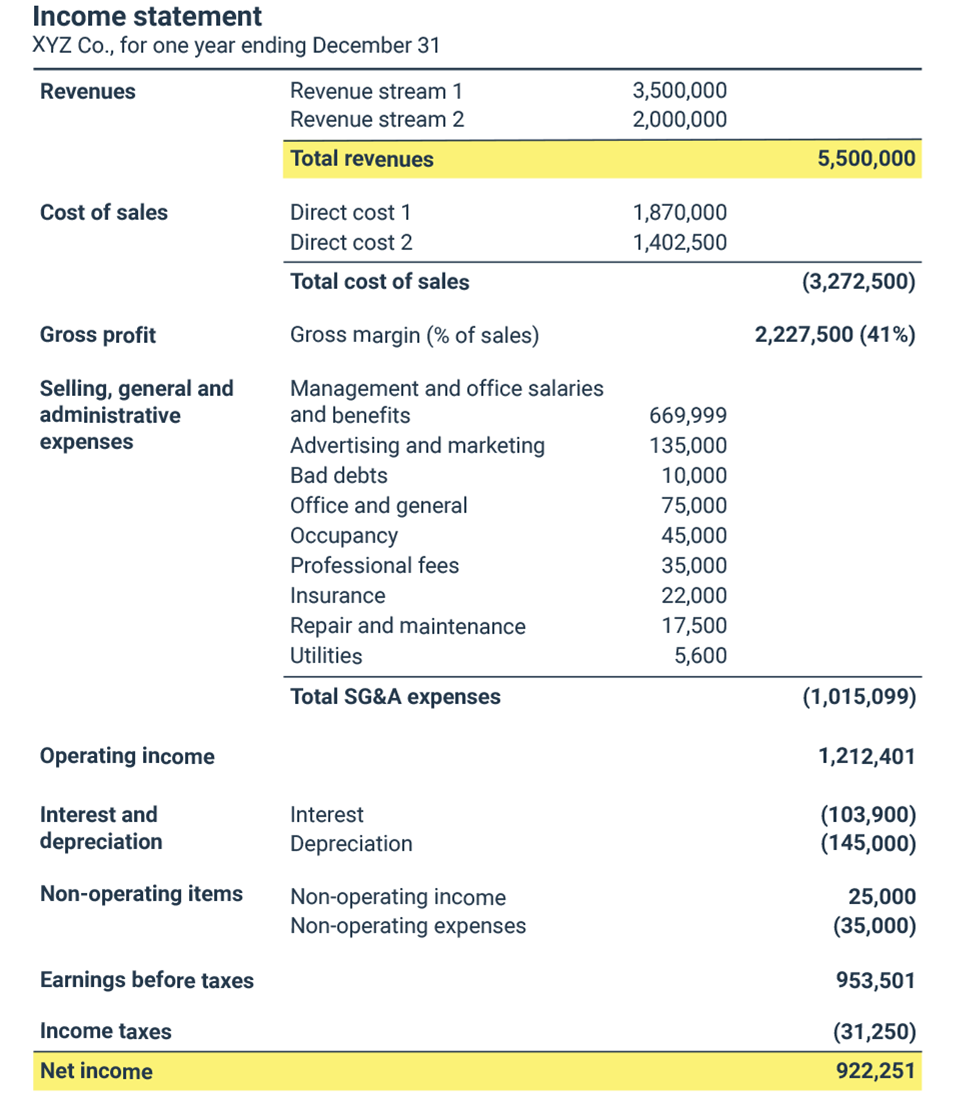

What Is The The Net Investment Income Tax Niit Forbes Advisor

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

. Youll owe the 38 tax. Lets say you have 30000 in net investment income and your MAGI goes over the threshold by 50000. For estates and trusts the 2021 threshold is 13050.

The statutory authority for the tax is. Prepare federal and state income taxes online. Ad Enter Your Tax Information.

In the case of an estate or trust the NIIT is 38 percent on the lesser of. Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low. Single or head of household 200000.

2019 Tax Bracket for Estate. Click the following link to. Long Term Capital.

Your net investment income is less than your MAGI overage. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. This same couple realizes an additional 100000 capital gain for total AGI of 350000.

The threshold amounts are based on your filing status. Tax Slab Rates for FY 2021-22 as per the New Regime. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

Married filing separately 125000. Your additional tax would be 1140 038. Long-term capital gains are gains on assets you hold for more than one year.

Rs 00 to Rs 25 Lakhs. Deduct the taxes already paid from the total tax payable this will be your net tax payable for the. We do not calculate the potential tax consequence.

The net investment income tax calculator is for a person who has modified adjusted gross income more than the threshold and also investment income. Calculate the tax payable for the financial year at the applicable income tax slab rate for FY 2022-23. Theyre taxed at lower rates than short-term capital gains.

Ad Learn How Our Equities Can Help Your Clients Pursue Their Investment Goals. The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year. Internal Revenue Code Simplified A Tax Guide That Saves You Money.

Calculate the tax payable for the financial year at the applicable income tax slab rate for FY 2022-23. April 28 2021 The 38 Net Investment Income Tax. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP.

This tax generally applies only to residents living within the OR Portland Metro District District as. See What Credits and Deductions Apply to You. For purposes of the NIIT investment income includes but isnt limited to.

Capital gains tax rates on most assets held for a year or less correspond to. Qualifying widow er with a child 250000. But youll only owe it on the 30000 of investment income you havesince its less than your MAGI overage.

All of the dividends will be taxed at 38 for a total of 380. Calculate the Tax Payable. Married filing jointly or qualifying widow er 250000.

Download Excel Based Income Tax Calculator For Fy 2020 21 Ay 2021 22 Financial Control. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. Individuals can determine the total tax expenses through an online income tax calculator.

The net investment income tax applies to taxpayers who have a significant amount of investment income typically high-net-worth families and individuals with considerable assets. Equities Backed By The Capital Systems Ongoing Rigorous Investment Analysis. The net investment income tax calculator is for a person who has modified adjusted gross income more than the threshold and also investment income.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. A the undistributed net investment income or. The threshold amounts are based on your filing status.

This tax is also known as the net investment income tax NIIT. Given the complexity of the 38 tax if this tax is applicable for you based on the guidelines above we encourage. If an adjustment is needed to the beneficiarys net investment income for section 1411 net investment income or deductions see below a manual adjustment will need to be made on Schedule K-1 Box 14 Code H Per IRS Instructions for Form 1041 and Schedules A B G J and K-1 on page 35.

Theyre taxed like regular income. Friday June 24 2022. B the excess if any of.

For more information on the Net Investment Income Tax refer to Tax filing FAQ. Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income Medicare contribution tax more commonly referred to as the net investment income tax NIIT. That means you pay the same tax rates you pay on federal income tax.

A Married Filing Jointly household has 300000 in income from self-employment and 10000 in dividends. E-File your tax return directly to the IRS. The investment income above the 250000 NIIT threshold is taxed at 38.

Net investment income tax 2021 calculator. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status. We are only required by the IRS to indicate annuity distributions.

Distributions on Net Investment Income. Income Tax Calculator - Individuals falling under the taxable income bracket are liable to pay a specific portion of their net annual income as tax. Apr 15 2021.

The 2022 tax values can be used for 1040-ES estimation planning ahead or comparison.

Capital Gains Tax Calculator 2022 Casaplorer

How To Calculate Income Tax Fy 2021 22 New Tax Slabs Rebate Income Tax Calculation 2021 22 Youtube

Tax Calculator Estimate Your Income Tax For 2022 Free

Easy Net Investment Income Tax Calculator

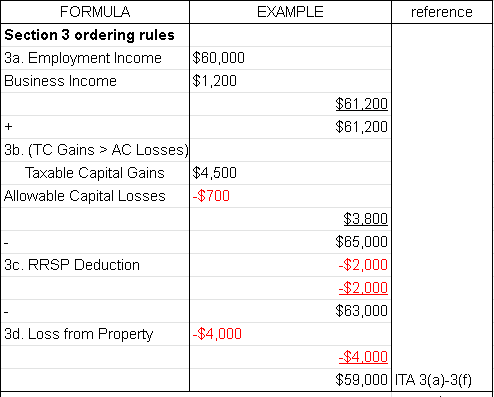

How Do You Get From Net Income For Tax Purposes To Taxable Income To Tax Payable Intermediate Canadian Tax

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 2022 Income Tax Calculator Canada Wowa Ca

How Do You Get From Net Income For Tax Purposes To Taxable Income To Tax Payable Intermediate Canadian Tax

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

How To Calculate Additional Medicare Tax Properly

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How To Calculate Income Tax Fy 2020 21 Examples New Income Tax Calculation Fy 2020 21 Youtube

Net Operating Profit After Tax Calculator Efinancemanagement

Canada Capital Gains Tax Calculator 2021 Nesto Ca

Understanding Tax Brackets Interactive Income Tax Visualization And Calculator Engaging Data

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)